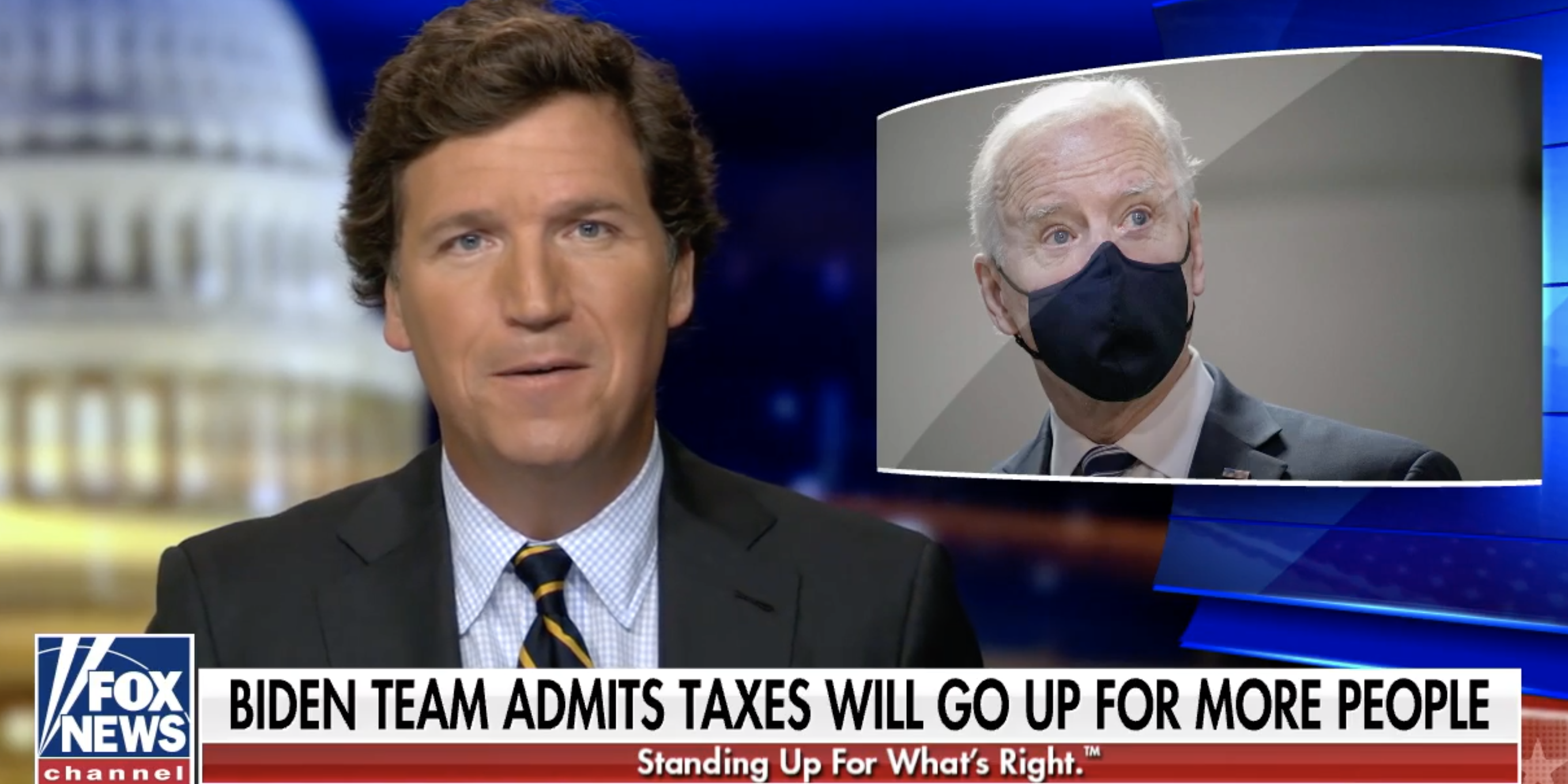

Screenshot/Fox News

- Tucker Carlson accused Biden of proposing a tax hike on wealthy Americans just to "punish" them.

- Biden has no plans to raise taxes on families making less than $400,000.

- Carlson falsely claimed that Biden will let very wealthy Americans and corporations off scot-free.

- See more stories on Insider's business page.

Far-right Fox News host Tucker Carlson accused President Joe Biden of proposing a tax hike on wealthy Americans to "punish" them and wrote off concerns about the federal debt during his Thursday night program.

Carlson argued Biden and Democrats have subscribed to an economic theory, known as Modern Monetary theory, which broadly holds the federal debt should not be an economic constraint, making taxes "beside the point."

"Why do we have taxes in the first place, at this point? We don't fund the government with tax revenue, we fund it with money that the federal reserve creates," Carlson said. "Why would you even consider raising taxes on families making 400 grand? Why would you even do that? To punish you, obviously."

The Biden administration has proposed a progressive tax increase on households that make more than $400,000, but won't raise taxes on families making less than $400,000. The vast majority of the revenue from Biden's tax increase will come from families who make $1 million or more. (The bottom 99% of Americans earn an average income of about $50,000.) Biden has long argued that wealthier Americans and coporations aren't paying their "fair share" in taxes.

Fewer than 2% of American taxpayers report annual income higher than $400,000 a year, a category that likely includes Carlson, who reportedly has an annual Fox News contract worth $10 million.

This comes a few years after former President Donald Trump and Republican lawmakers passed their $1.5 trillion tax cut, which gave rich Americans and corporations a massive tax break and will be far from deficit-neutral, as its supporters once claimed.

Carlson went on to falsely accuse Biden of letting the very wealthy and corporations off scot-free. Biden is reportedly considering raising the corporate tax rate from 21% to 28%.

"No billionaire's going to suffer. You're going to suffer, and for no good reason," Carlson said. "We don't fund the government with tax revenue, we fund the government with money the Federal Reserve makes up out of nothing."

Carlson rarely criticizes Trump, in part because many if not most of his audience are Trump supporters, but he's previously conceded that the 2017 GOP tax cut "was far better for corporate America than it was for the middle class."

The Fox host then brought on a guest, Victor David Hanson of the conservative Hoover Institution, who claimed Democrats would tax rich Americans to "punish people and tell their base they're going to redistribute income." Hanson warned that deficit spending would send the US into years of inflation, stagflation, and recession in a repeat of the 1970s. But inflation is currently at a 10-year low and Federal Reserve chairman Jerome Powell, who was appointed by Trump, said earlier this year that worrying inflation levels are "far away and unlikely."

Powell argued this week that Biden's $1.9 trillion stimulus package is "going to wind up accelerating the return to full employment" and urged Congress to spend even more on "investment in people's skills and aptitudes, investment in plant and equipment, investment in software" over the long term.

Biden's tax increase will help pay for his next set of legislative proposals, which will be focused on investing trillions of dollars in the nation's infrastructure. Conservatives have already said they won't support any bill that includes tax hikes on corporations and wealthy Americans.

During an ABC News interview that aired this week, Biden said he plans to pass a "small to significant tax increase" on families making over $400,000 annually. He insisted that his plan, unveiled during the presidential campaign, wouldn't raise "one single penny in additional federal tax" on American households making less than $400,000.

"The president remains committed to his pledge from the campaign that nobody making under $400,000 a year will have their taxes increased," White House press secretary Jen Psaki told reporters this week. "His priority and focus has always been on people paying their fair share and also focusing on corporations that may not be paying their fair share either."